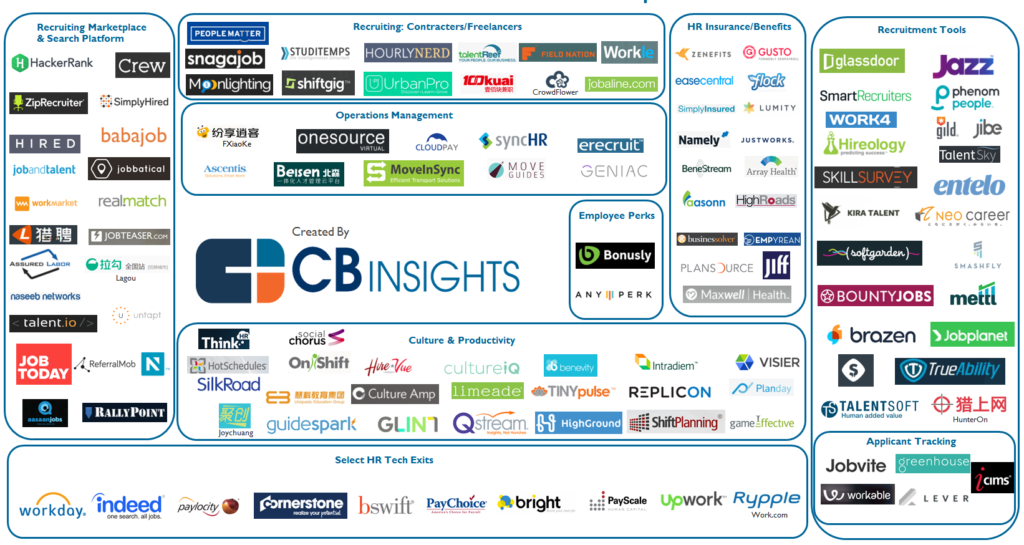

Needless to say, there are a ton of applicant tracking systems. Figuring out which one is the best fit for your business requires looking at that increasingly broad field of competitors and doing the research required to efficiently narrow down that list to a handful of final contenders and doing demos of those top choices.

Needless to say, there are a ton of applicant tracking systems. Figuring out which one is the best fit for your business requires looking at that increasingly broad field of competitors and doing the research required to efficiently narrow down that list to a handful of final contenders and doing demos of those top choices.With the proliferation of challengers vying for mind and market share rapidly evolving, new players and potential disruptors inevitably emerge, legacy solutions or acquisitions ride off into the software sunset, and change happens so fast that sometimes it can be hard for even the most hawk-eyed analyst – much less your average front line recruiter – to keep up with.

As the ATS landscape continues to evolve and mature, we wanted to shed some light into what’s often a nebulous market at best. We thought the best way to do this was by taking a hard look at the hard numbers surrounding marketshare and each ATS’ relative performance.

While imperfect and incomplete, as a metric goes, it’s as good a baseline as any for a business where business as usual is anything but these days.

Take a look at who’s growing the fastest, whose customers stay the longest and which brands may live up to the marketing buzz after all. A good look at the numbers reveals who’s worth a good look for recruiters looking to whittle down the playing field to only the most relevant tools and technologies on the market.

We hope that this deep dive offers employers a faster start when it comes to finding the best ATS for their company – and the biggest bang for their respective recruiting ROI.

A Deeper Dive Into The Data Set.

And now, a word for the nerds: this data set comes from Datanyze, a sales and investing intelligence platform. While an overwhelming majority of the solutions we looked at in our analysis are primarily categorized as applicant tracking systems, there are a few solutions on this list for whom applicant tracking is not considered a core capability.

With that disclaimer, we wanted to preserve the integrity of the data set, and therefore left these solution providers on the final list.

We figured that if we were offering an unbiased look at the best ATS’ on the market, it didn’t make much sense to leave off any system that actually helps companies make better hires faster. Even if those systems aren’t built explicitly for tracking applicants.

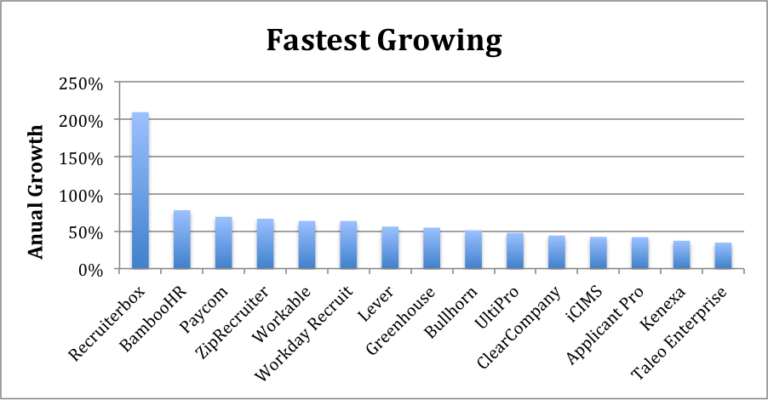

The Fastest Growing Applicant Tracking Systems.

First off, let’s look at which applicant tracking systems are growing the fastest. Out of the 95 different recruiting technology companies we tracked within our dataset, a handful stood out as having the kind of hockey stick growth indicative of an emerging contender experiencing hyper growth.

If you believe markets are an efficient system for determining viability and sustainability, then growth should be one of your only considerations – it tells you a lot, if you’re into the whole capitalism thing. The faster a company grows, the more value it has. It’s that simple.

Employers today are doing their research and increasingly picking these same companies from a crowded field, and if you’re looking for a new ATS, it might be worth checking out some of these tools and technologies, too.

I remember my early days in the HR Technology industry a few years back, when one of the most common complaints and recurring conversation topics in recruiting involved practitioners complaining about how unhappy they were with their ATS.

Every system had different workflows, which didn’t ever align exactly with what’s optimal for any one employer, meaning that no company was truly satisfied with how their system was set up. Add in the fact that these systems were full of old or outdated data, were cumbersome to use and were the victims of some pretty poor UI/UX decision making, and you’ve got the perfect storm for customer churn.

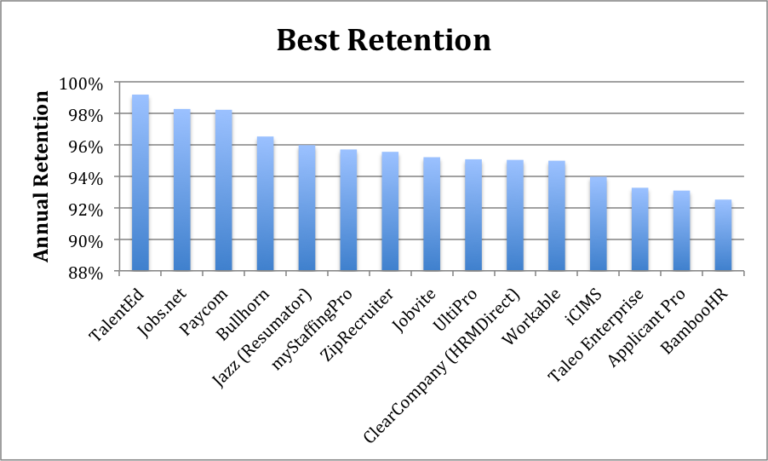

So, who weathered the waves the best? Our dataset shows something sort of funny when sorted by the applicant tracking systems that are the most effective at retaining their customers every month. Most surprisingly is that some of the vendors topping this list of best ATS providers in terms of retention aren’t even ATS solutions to start with.

Realistically, looking at this list, you’ve got to jump down to Jazz at the #5 spot before you even get to a “pure” ATS vendor; from there, it’s a few more spots down to Jobvite, the second highest rated provider on this list. Greenhouse ranked a distant #16 with an annualized churn of 8%, ahead of Lever, in 23rd place with 13% annualized churn.

ATS Market Share.

When it comes to which companies have the most overall share of the ATS market, we broke down the list and came up with the following overall rankings for applicant tracking providers. It’s important to note that we’re defining marketshare as the number of websites that currently utilize any given companies’ technology.

This means a company like Taleo likely has an even greater market share than seen on this list, given the fact that they charge significantly more than competitors like Jazz or Workable, who target the SMB space and therefore have a much lower average deal size.

TL;DR: Taleo is crushing it, despite being probably the most painful user experience conceivable for both TA professionals and job seekers. Apparently that business link between profitability and candidate experience doesn’t actually extend to the sector that’s seemingly obsessed with this correlation.

| Ranking | Technology | Domains | Market Share |

| 1 | Taleo | 12,361 | 11.22% |

| 2 | Taleo Enterprise | 7,490 | 6.80% |

| 3 | iCIMS | 5,976 | 5.42% |

| 4 | Taleo Business Edition | 5,174 | 4.69% |

| 5 | UltiPro | 4,146 | 3.76% |

| 6 | SilkRoad | 4,024 | 3.65% |

| 7 | Jobs.net | 3,479 | 3.16% |

| 8 | Jazz (Resumator) | 3,283 | 2.98% |

| 9 | Jobvite | 3,258 | 2.96% |

| 10 | ClearCompany (HRMDirect) | 2,662 | 2.42% |

| 11 | Workable | 2,635 | 2.39% |

| 12 | ZipRecruiter | 2,159 | 1.96% |

| 13 | Kenexa | 2,030 | 1.84% |

| 14 | Applicant Pro | 1,911 | 1.73% |

| 15 | Greenhouse | 1,906 | 1.73% |

| 16 | Workday Recruit | 1,697 | 1.54% |

| 17 | myStaffingPro | 1,676 | 1.52% |

| 18 | SmartRecruiters | 1,630 | 1.48% |

| 19 | TalentEd | 1,477 | 1.34% |

| 20 | BambooHR | 1,444 | 1.31% |

| 21 | Lever | 1,432 | 1.30% |

| 22 | Recruiterbox | 1,422 | 1.29% |

| 23 | Bullhorn | 1,382 | 1.25% |

| 24 | Paycom | 1,351 | 1.23% |

| 25 | SuccessFactors (SAP) | 1,283 | 1.16% |

| 26 | Zoho Recruit | 1,231 | 1.12% |

| 27 | CATS | 1,148 | 1.04% |

| 28 | Tenstreet | 1,028 | 0.93% |

| 29 | Newton Software | 996 | 0.90% |

| 30 | PC Recruiter | 924 | 0.84% |

| 31 | Monster ATS | 865 | 0.78% |

| 32 | ApplicantStack | 861 | 0.78% |

| 33 | JazzHR | 826 | 0.75% |

| 34 | Erecruit | 825 | 0.75% |

| 35 | ADP Employease Applicant Tracking | 816 | 0.74% |

| 36 | JobDiva | 784 | 0.71% |

| 37 | Lumesse | 768 | 0.70% |

| 38 | OTYS | 741 | 0.67% |

| 39 | Lumesse (US only) | 722 | 0.66% |

| 40 | iApplicants (ApplicantPro) | 658 | 0.60% |

| 41 | ATS OnDemand | 630 | 0.57% |

| 42 | PeopleFluent | 600 | 0.54% |

| 43 | Jobscore | 556 | 0.50% |

| 44 | JobAdder | 551 | 0.50% |

| 45 | Umantis | 542 | 0.49% |

| 46 | People Matter | 530 | 0.48% |

| 47 | CareerBuilder | 517 | 0.47% |

| 48 | Kronos | 458 | 0.42% |

| 49 | Maxhire | 391 | 0.35% |

| 50 | ApplicantPool | 382 | 0.35% |

| 51 | Carerix | 373 | 0.34% |

| 52 | Avature | 366 | 0.33% |

| 53 | Broadbean | 357 | 0.32% |

| 54 | Sendouts | 343 | 0.31% |

| 55 | SearchSoft | 335 | 0.30% |

| 56 | HireBridge | 329 | 0.30% |

| 57 | Hireology | 329 | 0.30% |

| 58 | BirdDogHR | 321 | 0.29% |

| 59 | PageUp People | 297 | 0.27% |

| 60 | SmartSearch | 274 | 0.25% |

| 61 | MidlandHR | 272 | 0.25% |

| 62 | Technomedia (Hodes iQ) | 256 | 0.23% |

| 63 | aCloud Recruitment | 254 | 0.23% |

| 64 | Hyrell | 249 | 0.23% |

| 65 | Health eCareers | 248 | 0.23% |

| 66 | Breezy HR (Formerly NimbleHR) | 241 | 0.22% |

| 67 | Recruitics | 240 | 0.22% |

| 68 | Infor (PeopleAnswers) | 239 | 0.22% |

| 69 | ExactHire | 237 | 0.22% |

| 70 | TheJobNetwork by RealMatch | 235 | 0.21% |

| 71 | Recruitee | 231 | 0.21% |

| 72 | HR 4 You | 228 | 0.21% |

| 73 | Madgex | 220 | 0.20% |

| 74 | The Applicant Manager (TAM) | 219 | 0.20% |

| 75 | Eteach | 214 | 0.19% |

| 76 | Prevue | 213 | 0.19% |

| 77 | GetHired.com | 198 | 0.18% |

| 78 | Jobtrain | 195 | 0.18% |

| 79 | Talent Clue | 192 | 0.17% |

| 80 | Dice | 189 | 0.17% |

| 81 | BrightMove | 187 | 0.17% |

| 82 | Zywave HR Connection | 185 | 0.17% |

| 83 | TalentSoft | 170 | 0.15% |

| 84 | Winocular | 163 | 0.15% |

| 85 | WCN | 158 | 0.14% |

| 86 | Firefish Software | 154 | 0.14% |

| 87 | JobApp | 153 | 0.14% |

| 88 | AcquireTM | 150 | 0.14% |

| 89 | iRecruit | 146 | 0.13% |

| 90 | Emply | 145 | 0.13% |

| 91 | CareerArc | 142 | 0.13% |

| 92 | Njoyn | 140 | 0.13% |

| 93 | IBM Kenexa BrassRing | 139 | 0.13% |

| 94 | Vacancy Filler | 138 | 0.13% |

| 95 | Hirewire | 137 | 0.12% |

| 95 | Hirewire | 137 | 0.12% |

Where The Data Falls Short.

- Unfortunately, this data set has a few major flaws, some of which should be painfully obvious. The most glaring example of this is the handful of non-ATS providers who made the final list; sure, some companies may use ZipRecruiter as an ATS, but not most. Jobs.net? Forget about it. Everyone else seems to have already done so.

- We can assume some level of bias in interpreting the results of sites Datanyze crawls, since they don’t look at every webpage on the internet, but rely instead on a smaller representative sample for their findings.

- This means that many smaller companies who use SMB providers like Jazz may not be included in here. Workable, for example, says they have 6,000 active customers while our data set showed only 2600; similarly, RecruiterBox claims of 2k customers didn’t stack up to the 1400 our sources showed.

- The growth and churn numbers here are based solely on March, 2017. These were the latest and most comprehensive numbers available, so if a company had a stellar sales month, or had historic churn, then it’s going to greatly impact the growth and retention numbers presented in this post. We plan to fix this by updating this data in a few months.

Where to go from here.

These numbers are simply another data point to consider when searching for the best ATS for your company, and these findings are by no means exhaustive nor are they intended to be prescriptive. They are simply a snapshot of the state of the ATS market today at a distinct moment in time. That’s about as good as it gets with the data we’ve got.

For what it’s worth, the ATS vendors that we hear the most are Greenhouse, SmartRecruiters, iCIMS and Lever (editor’s note: for what it’s worth, all these companies are also RecruitingDaily clients); however, it’s worth noting that none of these solutions are designed as enterprise solutions, and despite larger deal sizes of late, started out strictly focused on the middle market.

This means that if you’re a Fortune 500 employer or multinational, you’re likely stuck with larger, clunkier legacy solutions and are less likely to have the flexibility or capability of making a change. Don’t worry. Eventually, you’ll have to select a new ATS, and the good news is, there are some pretty awesome options out there (and getting better by the day).

Editor’s Note: NextWave Hire is an advisory services client of RecruitingDaily, and the views expressed herein do not necessarily reflect those of RecruitingDaily or its partners. RecruitingDaily was not compensated for publishing this post. We just thought it was really interesting.

About The Author:

Phil Strazzulla is the founder/CEO of NextWave Hire, a recruiting and HR technology startup which builds software to help make it easy for employers to create the content that explains why their company is a compelling place to work – and effectively attract top talent.

Phil Strazzulla is the founder/CEO of NextWave Hire, a recruiting and HR technology startup which builds software to help make it easy for employers to create the content that explains why their company is a compelling place to work – and effectively attract top talent.

Before NextWave Hire, he was a venture capital investor at Bessemer Venture Partners, the oldest VC in the world which has made investments in companies such as LinkedIn, Cornerstone On Demand, Skype, Yelp, Pinterest and many others.

Phil started investing at the age of 11 when he opened his first brokerage account and hasn’t stopped since.

Follow Phil on Twitter @PhilStrazzulla or connect with him on LinkedIn.

Authors

Phil Strazzulla

Phil Strazzulla is the founder of SelectSoftware, a site dedicated to helping HR professionals buy the right software and tools through free online guides. Phil started his career working in venture capital at Bessemer before attending Harvard Business School for his MBA. He originally got into the People space by starting NextWave Hire, a recruitment marketing software company. Follow Phil on Twitter @PhilStrazzulla or connect with him on LinkedIn

Recruit Smarter

Weekly news and industry insights delivered straight to your inbox.